y 2030, India’s fintech sector could potentially contribute to approximately 13% to global fintech industry’s total revenue. Technological innovation by FinTech’s is a result of the interplay between digital public infrastructure, institutional arrangements and policy initiatives” said RBI Governor, Shaktikanta Das. He was speaking at the Global Fintech Fest 2023. During the keynote addressed titled ‘Rise of Financial Democracy in India: A Fintech Odyssey’ he discussed a diverse range of topics including digital payments, inclusive banking, microfinance, regulatory advancements and many more areas revolutionizing financial access, empowering individuals, and driving economic growth.

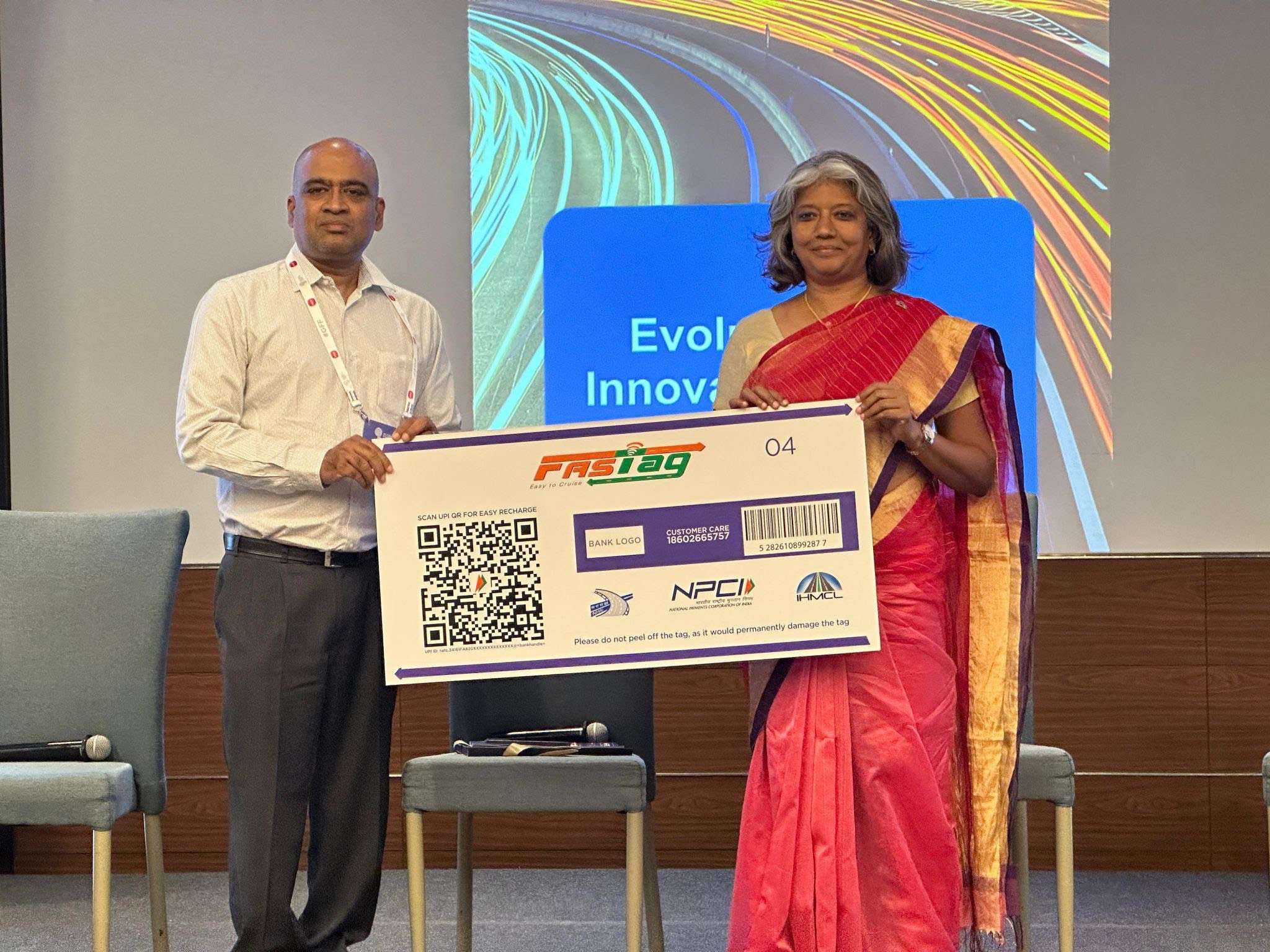

The Global Fintech Fest (GFF) is the largest fintech conference, jointly organized by the National Payments Corporation of India (NPCI), the Payments Council of India (PCI), and the Fintech Convergence Council (FCC). With GFF, the aim is to provide a singular platform for fintech leaders to foster collaborations and develop a blueprint for the future of the industry.

GFF 2023, the fourth edition of the conference, is taking place from September 5 to 7, 2023 at the Jio World Centre in Mumbai. The theme of GFF 2023 is ‘Global Collaboration for a Responsible Financial Ecosystem – Inclusive | Resilient | Sustainable’.

More than 500 exhibitors from the public and private sector are participating in the Global Fintech Fest this year.

The Reserve Bank of India’s pavilion is an extension of it’s effort to connect with the Fin Tech Players. RBI’s main focus has been on policy making which is the backbone of payment system and security features that we see today..

State Bank of India has over the years focused on giving payment solution to the banking industry. Participating in the fest, they are also looking for suitable partners in the exhibition with whom they can provide customised services to customers.

The India Post exhibit at GFF provides info about launch of new services digitally like Aadhar Base Account, Zero Balance Down Payment and Door-Step Banking with instant account opening.

Along with “Digital Public Infrastructure”, another priority focus areas under the Indian G20 presidency is “Information sharing on national experiences and international initiatives on interoperability of national fast payment systems for seamless flow of funds.

Embracing the same spirit, GFF23 is dedicated to fostering global collaborations among stakeholders and exploring key issues, and devising business models that contribute to building an inclusive, resilient, and sustainable world.