Zoom through tolls

Save Time and Fuel. Get your FASTag today!

20% Reduced CO2 Emissions

Over 90% Adoption Rate

Fuel Savings of up to 15%

Electronic Toll Collection via FASTag

IHMCL’s nation-wide Electronic Toll Collection Program is about implementing unified and interoperable ETC solution for National Highways in India based onRFID technology conforming to EPC Gen-2, ISO 18000-6C standards.

Download “My FASTag” App now!

Download “My FASTag” App now!

iOS App

Android App

Portal Link

Frequently Asked Questions

If your FASTag KYC is incomplete, you will receive notification via email, SMS, or through issuing bank’s application interface regarding incomplete KYC. You are requested to keep an eye on your registered communication channels such as SMS, e-mail, etc. for updates. The KYC can be updated online as per following procedure:

For FASTag issued by NHAI

- Visit https://fastag.ihmcl.com

2. Login

3. Update KYC Online

For FASTag issued by different banks

- Visit website – https://www.netc.org.in/request-for-netc-fastag

- Under Request for NETC FASTag, Select your FASTag issuer bank and click on the visit website link.

- Login to respective FASTag issuer bank

- Update KYC Online

In case you have not received any notification or reminder from your bank that means your KYC is complete and no action is required from your end.

No, the ‘One Vehicle One FASTag’ concept indicates that a vehicle owner is permitted to have only one active FASTag for one vehicle. All the FASTags linked to a single vehicle except the latest one shall be de-activated. Acquiring multiple FASTags for a single vehicle is not permitted. However, users have the flexibility to recharge their FASTag using any bank and various payment methods such as BBPS, UPI, net banking, etc.

To check the status of multiple FASTags linked to your vehicle, you can follow below steps:

- Visit the official link: https://www.npci.org.in/what-we-do/netc-fastag/check-your-netc-fastag-status

- Enter your vehicle details.

- Click “Submit.”

- View the status of all the FASTags linked to your vehicle number.

FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly while the vehicle is in motion. FASTag (RFID Tag) is affixed on the windscreen of the vehicle and enables a customer to make the toll payments directly from the account which is linked to FASTag. FASTag is operational at over 750 toll plazas, including all NH toll plazas and over 100 SH toll plazas in India.

A. For Road Users

- Near non-stop motion through toll plazas

- Convenience for cashless payment of toll fee

- Less traffic congestion and reduced commute times

- Toll statements which can be mailed or made available online

- Near non-stop motion through toll plazas

- Convenience for cashless payment of toll fee

- Less traffic congestion and reduced commute times

B. For Toll Operator

- Lower operating costs

- Better audit control through centralized user accounts

- Improved capacity without being required to build more infrastructure

C. For Government

- Savings on fuel and reduction of emissions from idling and repeated stops at toll plazas

- Improves transparency of toll transactions

Yes. As per amendments in the CMVR 1989 by the Ministry of Road Transport & Highways, FASTag is mandatory for all class M & N vehicles (four wheelers and above, carrying goods and/or passengers) w.e.f. 1st January 2021.

Yes. As per amendments in the CMVR 1989 by the Ministry of Road Transport & Highways, FASTag shall be made mandatory while getting a new 3rd party insurance w.e.f. 1 April 2021.

FASTag is a flagship programme of the Ministry of Road Transport and Highways & NHAI. Indian Highways Management Company Limited (IHMCL), a company promoted by NHAI has been mandated to implement FASTag programme in India.

National Payments Corporation of India has been engaged to provide Clearing & Settlement House (CCH) services for this FASTag Programme. Currently 26 banks have been certified by IHMCL for issuance of FASTag in India and 12 banks have been certified to carry out acquiring services at toll plazas.

A blacklisted tag means the tag which has been blocked by the issuer bank and cannot be used to pay toll at a toll plaza. There are various reason of blacklisting of tag, i.e. Tag is not having sufficient balance in FASTag account. In such cases Customer should call his bank toll free call center numbers and get the reason of blacklist. To avoid Blacklisting of tag, customer should recharge his tag when he gets the alert of low balance from his bank.

Also, FASTag may get blacklisted in case of any violation such as vehicle – tag class mismatch, non-affixation on the windscreen and carrying in hand, etc.

The physical tag has a validity of 5 years and after purchasing, you only need to recharge/ top up the tag as per your usage.

The categorization is primarily based on the size and load they carry and type of use (commercial/personal) of a vehicle.

FASTag can be purchased from Offline as well as Online mode:

Offline: Point-of-sale (POS) set up at following locations

- All NH toll plazas

- Over 40,000 Point-of-Sale locations set up by 26 member banks

- Selected bank branches of 26 certified banks

- RTOs

- Transport hubs

Online: FASTag can be bought online also as below;

- For NHAI FASTag – Visit Flipkart App or other E-commerce websites

- For all other bank issued FASTag – FASTag can be purchased from respective bank portals. Some of the leading banks are:

- Paytm Payments Bank (via Paytm App)

- ICICI bank (iMobile App) o Axis Bank

- HDFC bank

- IDFC First Bank

- Airtel Payments Bank (via Airtel App)

- Others

In digital issuance mode, FASTag can be availed from all bank branches of leading private sector banks such as ICICI bank, HDFC bank, Axis bank, etc.

You will need to carry original as well as copy of your KYC document

You need to submit the following documents along with the application for FASTag:

- Registration Certificate (RC) of the vehicle.

- Passport size photograph of the vehicle owner.

- KYC documents as per the category of the vehicle owner.

- Online Portal for customers

| Individual | ||||

| ID proof and Address proof from the list mentioned, and 1 passport size photograph | ||||

| Driving License | PAN Card | Passport | Voter ID Card | Aadhaar Card (with address) (Currently Not Accepted) |

| A valid driving license would be sufficient for Address & ID proof. | ||||

| Corporate (Non-Individual) | |

| Public Ltd./ Private Ltd./ Partnership | Proprietorship |

| Certificate of Incorporation/ Partnership Deed/Registration certificate of the firm | PAN Card of Proprietor |

| PAN Card of the corporate | Address Proof of the Proprietor |

| Photo ID of signing authority | Shop Act or other Firm Proof |

| List of Directors with addresses/Name and addresses of Partners | |

| Pan Card (if HUF is taken as Customer) – Currently Available in the Customer Portal | |

| Udyog Aadhaar – Currently Available in the Customer Portal | |

| Sales Tax Registration – Currently Available in the Customer Portal | |

Government has regulated the FASTag maximum price (tag cost) at maximum Rs. 100 incl. GST. In addition to that a security deposit of Rs. 200 and first recharge amount of Rs. 200 are usually charged by banks depending on the vehicle class. It is advisable to maintain sufficient balance in FASTag wallet to avoid hassle at toll plazas.

NHAI FASTag is a bank-neutral variant of FASTag, i.e. no bank is linked to the FASTag at the time of purchase by a customer from a designated Point-of-Sale such as toll plaza, petrol pump, Online etc. The customer sha the flexibility to chose to link the FASTag with any of his/her existing bank account through My FASTag App as per his/her convenience. While linking the tag with existing bank account, a customer needs to keep a threshold limit/lien marking for processing debit adjustment from the bank account (threshold amount may vary from bank to bank).

In order to buy FASTag, customer has to visit any of the Point of Sale (PoS) locations at Toll Plazas / PoS outlets of the NETC Member Banks/their distribution agents/ their Sales offices. Alternatively, you can also apply online at the respective issuer bank’s website or at www.nhai.gov.in

The activation process is simple as all one need to do is download My FASTag App (available on both Android & iOS platforms) and enter the vehicle details into the My FASTag App and follow the steps as mentioned in the App. Step by step process of activation/linking of NHAI FASTag is also available in form of an instructional video in the App.

Users who have registered their mobile number with NHAI Prepaid Wallet can know the balance by giving a missed call at +91-8884333331. The number is toll free and the facility is available round the clock.

A. If I am a Non-KYC Customer, Will I be receiving any kind of communication to do the KYC?

- Yes, you will be sent 4 SMS at the end of 2 years, notifying you to do the KYC upgrade in order to enjoy uninterrupted services. The SMS content is given below:

- Day 639 — Your FASTag Wallet is getting expired, pls update your KYC documents on https://fastag.ihmcl.com or call 1033 to enjoy uninterrupted services – IHMCL

- Day 701 — Your FASTag Wallet is getting expired, pls update your KYC documents on https://fastag.ihmcl.com or call 1033 to enjoy uninterrupted services – IHMCL

- Day 730 — Your FASTag Wallet is getting expired, pls update your KYC documents on https://fastag.ihmcl.com or call 1033 to enjoy uninterrupted services – IHMCL

- Day 731 — Your FASTag Wallet has expired, pls update your KYC documents on https://fastag.ihmcl.com or call 1033 to enjoy uninterrupted services – IHMCL

B. How do I know if my FASTag KYC is incomplete?

- If your FASTag KYC is incomplete, you will receive notification via email, SMS, or through issuing bank’s application interface regarding incomplete KYC. You are requested to keep an eye on your registered communication channels such as SMS, e-mail, etc. for updates. The KYC can be updated online as per procedure given at FAQ No. 3.5 c.

In case you have not received any notification or reminder from your bank that means your KYC is complete and no action is required from your end.

C. What will happen if I have not upgraded my KYC post 2 years of completion as a Non-KYC wallet customer?

- You will be restricted from recharging the wallet you have not upgraded your KYC post 2 years of completion as a Non-KYC wallet customer. But you will be able to use the existing balance for toll transactions till your tags are marked “Low Balance” and blocked from using further.

D. How do I update my KYC?

- If you need to update your KYC details to upgrade from Non – KYC customer to Full – KYC customer, please follow these steps:

- You can login via the dedicated customer web portal in the provided link https://fastag.ihmcl.com and use your registered mobile number and password or OTP based validation to login into the IHMCL customer portal.

- Once you login to the IHMCL customer portal, you can view the Dashboard Menu and in the left side Menu of the Dashboard, select the “My Profile” option, post which the “My Profile” page will be displayed. In that “My Profile” page, you can see the status of your KYC and all the profile details that you have submitted during the Registration process.

- In the same page, you need to click the ‘KYC’ sub-section next to ‘Profile’ sub-section. Then, in the ‘KYC’ sub-section, you need to select the “Customer Type” and then fill the mandatory fields by submitting the required ID Proof and Address Proof documents along with your passport size Photo and Address (as per Address Proof).

- Before submission of these details, you must mandatorily tick the“Declaration:I/We confirm the attached documents are authentic documents. I/We have the originals with us” for proceeding further with the KYC verification process.

E. How much time will it take for my KYC request to get processed?

- Your KYC will be processed in maximum 7 working days from the date of submission of your request for KYC upgrade. Post submission of KYC request, you can check the status of your KYC in the “My Profile” page of the Customer portal itself.

- If all your submitted documents are valid and matches with the information as provided by you during the KYC updation and Customer Registration, then your KYC verification will be accepted and your KYC status will get changed.

- If there is any mismatch in the information provided or if submitted documents are not proper/valid, then your KYC will get rejected and the same will be alerted to you for updating again in the same manner.

F. Does the concept of ‘One Vehicle One FASTag’ imply that a vehicle owner must exclusively recharge their FASTag using a specific bank?”

No, the ‘One Vehicle One FASTag’ concept indicates that a vehicle owner is permitted to have only one active FASTag for one vehicle. All the FASTags linked to a single vehicle except the latest one shall be de-activated. Acquiring multiple FASTags for a single vehicle is not permitted. However, users have the flexibility to recharge their FASTag using any bank and various payment methods such as BBPS, UPI, net banking, etc.

FASTag recharge can be done both by paying cash or online.

a) Recharge of bank issued FASTag (i.e. FASTag purchased from a bank)

- Any FASTag issued by bank can be recharged by visiting respective bank web-portal. On submitting user credentials, a wallet associated with FASTag can be recharged via net banking, UPI and debit/credit card.

- FASTag issued by banks can also be recharged via UPI on My FASTag App (available on Android Play Store, iOS version coming soon)

- Customer may also call respective bank’s customer care number for assistance/information on recharge

b) Recharge of NHAI FASTag (i.e. bank neutral FASTag)

- The NHAI FASTag which are linked to NHAI prepaid wallet can be recharged via UPI on My FASTag App through net banking, UPI and debit/credit card.

- Those NHAI FASTag which are linked to a bank account via My FASTag App are automatically topped up once the balance goes down below minimum threshold amount. The amount of auto-top can be chosen by customer by providing standing instruction while linking the tag with bank account.

Yes, FASTag can also be recharged via Bharat Bill Payment System (BBPS) at POS located at all toll plazas.

The customers have to follow the below steps:

- Login to BHIM UPI App.

- Select Send Option.

- Enter NETC FASTag UPI ID which will be“netc.vehiclenumber@bankupihandle”

- Click Verify UPI ID.

- Enter the desired recharge amount.

- Enter the pin to authenticate the transaction.

- Customers will receive an SMS confirming them of the credit to their FASTag wallet.

-

Recharge option is available on 100+ UPI enabled apps like Paytm, Google pay, Phone pe, etc.

UPI ID of FASTag is NETC.VehicleRegistrationNumber@Customer bank. For e.g. Vehicle Registration number is MH04BB1234 and issuer bank is ICICI Bank then UPI ID will be netc. MH04BB1234@ICICIbank. Customer should get the UPI ID validated with his bank before recharging FASTag throughUPI.

The list of UPI handle of various bank are as below –

| Sr. No. | Bank Name | Bank UPI Handle |

| 1 | Airtel Payment Bank | @mairtel |

| 2 | Axis Bank | @axisbank |

| 3 | Bank Of Baroda | @barodampay |

| 4 | City Union Bank | @cub |

| 5 | Equitas Small Finance Bank | @equitas |

| 6 | Federal Bank | @fbl |

| 7 | HDFC Bank | @hdfcbank |

| 8 | ICICI Bank | @icici |

| 9 | IDFC First Bank | @Idfcnetc |

| 10 | Indusind Bank | @Indus |

| 11 | KVB Bank | @Kvb |

| 12 | Kotak Mahindra Bank | @Kotak |

| 13 | Paytm Bank | @paytm |

| 14 | Punjab National Bank | @pnb |

| 15 | South Indian Bank | @sib |

| 16 | State Bank of India | @sbi |

Recharge/top up amount can be as low as Re. 1 for any existing FASTag wallet. However, the First Recharge Amount at the time of purchase of FASTag is normally Rs. 200(excluding security amount), which varies as per pricing policies of different banks.

If Customer has recharge the Tag and amount debited this account but not credited to his FASTag account Customer should call on his bank Call center and raise the request for reversal.

The tag is detected by the RFID readers installed at the toll lanes. A transaction file is created which is sent by the ETC System Integrator to the acquirer bank of the toll plazas. Acquirer bank then passes this transaction to the respective issuer bank through the CCH service provider (NPCI). And the appropriate toll amount is deducted from the FASTag account of the customer and subsequently passed on to the concessionaire/toll operator account.

Around 720+ toll plazas are live on FASTag now. List of toll plaza is available on IHMCL or NHAI website.

Only vehicles fitted with FASTag are allowed to enter FASTag lanes of NH toll plazas. MoRTH has already directed to convert all lanes in each direction as FASTag lane. A vehicle without valid FASTag entering FASTag lane will be charged double the applicable toll amount in cash.

Customers will receive an SMS alert on their registered phone number each time an amount is deducted from their FASTag wallet. Fee payable on each NH toll plaza is displayed at every toll plaza and can also be viewed online on website www.nhtis.org or Sukhad Yatra Mobile App.

You can report an incorrect deduction by calling our call center within 40 days of the transaction date. For all toll transactions, the toll plaza system sends a request to Bank for debiting the toll amount that is due from you. In the rare scenario of Toll Plaza system sending an incorrect amount, Bank would raise a Chargeback on behalf of you to recover the money that has been collected in excess by Toll Plaza. This Chargeback process normally takes up to 20-30 working days. All incorrect deductions, if proven so, are reverted back post representing the case with Toll Plaza.

In case ETC equipment are not working and you have a valid and functional FASTag with sufficient balance in it then you will be permitted to pass the toll plaza free of cost. Additionally, please call our customer care and also report the issue with the concessionaire.

In case of such a scenario, a complaint is to be lodged with respective Project Directors at the toll plaza. Further, the incident may be reported at etc.nodal@ihmcl.com or call on toll free number 1033.

Normally one vehicle is assigned with one FASTag issued by a bank. However, under circumstances, if the vehicle user is not satisfied with the service of a bank, they can get new FASTag assigned provided that the earlier tag has not been blacklisted by the bank due to various issues such as non-payment of toll,etc.

No, as per guidelines FASTag is issued to each vehicle based on RC copy of the vehicle. If there is mismatch, the ETC system at the toll plaza will detect the class mismatch and the FASTag is liable to be ‘blacklisted’ by the issuer bank and no new FASTag can be issued further against that vehicle number. FASTag users are advised to desist from such practice.

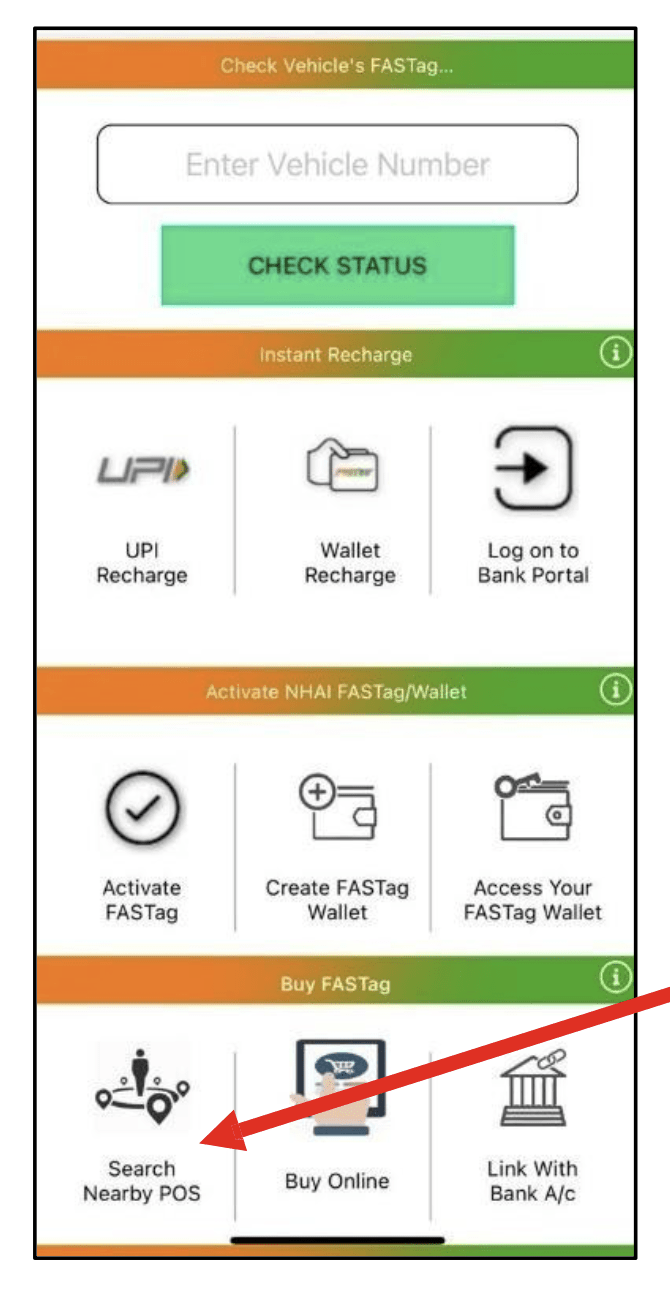

One can search for nearest Point-of-Sale by following ways:

A. Downloading My FASTag App (Refer – Figure 1)

- Click “Search Nearby POS”

- Search option available – State, City and Bank OR by PIN code

B. Visit ihmcl.co.in website

- Go to ‘FASTag’ Users TabàNearby POS Location

- Search option available – Search option available – State, City and Bank OR PIN code

C. Call 1033 Helpline number

D. One can also get to know nearest point-of sale location for bank issued FASTag by Calling Toll -Free number of certified issuer banks as below:

| Sr No. | Issuing Bank | Customer Care Helpline No |

| 1 | Airtel Payments Bank | 400/8800-688-006 |

| 2 | Allahabad Bank | 1800-258-6680 |

| 3 | AU Small Finance Bank | 1800-258-7300 |

| 4 | Axis Bank Ltd | 1860-419-8585 |

| 5 | Bank of Baroda | 1800-103-4568 |

| 6 | Canara Bank | 1800-103-3568 |

| 7 | City Union Bank Ltd | 1800-258-7200 |

| 8 | Equitas Small Finance Bank | 1800-103-1222 |

| 9 | Federal Bank | 1800-266-9520 |

| 10 | FINO Payments Bank | 022-6868-1414 |

| 11 | HDFC Bank | 1800-120-1243 |

| 12 | ICICI Bank | 1800-210-0104 |

| 13 | IDBI Bank | 1800-266-1962 |

| 14 | IDFC First Bank | 1800-266-9970 |

| 15 | IndusInd Bank | 1860-210-8887 |

| 16 | Karur Vysya Bank | 1800-102-1916 |

| 17 | Kotak Mahindra Bank | 18-602-666-888 |

| 18 | Nagpur Nagarik Sahakari Bank | 1800-266-7183 |

| 19 | PAYTM Bank | 1800-120-4210 |

| 20 | Punjab National Bank | 1800-419-6610 |

| 21 | Saraswat Bank | 1800-229-999/1800-266-5555 |

| 22 | South Indian Bank | 1800-425-1809 |

| 23 | State Bank of India | 1800-110-018 |

| 24 | Syndicate Bank | 1800-3011-3333 |

| 25 | Union Bank of India | 1800-258-6400 |

| 26 | YES BANK | 1800-3000-1113 |

One may download My FASTag App – and check the real-time balance in the FASTag wallet assigned with the vehicle number.

Similar to the “You are Safe” feature in Aarogya Setu App, a new feature to show the Tag Balance status has been introduced on My FASTag App. This new feature shall show the real-time FASTag wallet balance in form of colour code –

- Green for Active tag with sufficient balance

- Orange for tags with low balance and

- Red for blacklisted

This feature shall help FASTag user with sufficient FASTag wallet balance to pass through a toll lane by showing the tag status of the assigned vehicle, in case the tag status has not been updated in the toll plaza server due to various reasons.

FASTag system provides a unified and interoperable Electronic Toll Collection (ETC) solution. Currently, FASTag is operational at over 110 state toll plazas across India.

With a view to enhance the coverage of NETC programme and offer seamless services to consumers across the country, a Scheme Guidelines for inclusion of State/City Toll Plazas under NETC Programme (FASTag) was unveiled by the Hon’ble Minister MoRTH in January 2019. The Scheme provides financial assistance to state governments as below:

- 50% of the CAPEX cost of ETC infrastructure installation subject up maximum 20 lakhs per toll plaza

- ETC programme management fees @ 1% of transaction value (charges to issuer banks and Clearing & Settlement charges)

A pilot on parking payment via FASTag has also been carried out at Hyderabad International airport.

It is also envisaged to extend the usage of FASTag to other vehicular payments such as fuel payment, e-challan and various other payments at wayside amenities.

FASTag is accepted at 720+ toll plazas on National & State Highways across the country. FASTag enabled toll plaza are having hoarding before 500 meters of the plaza and the lane at the plaza are having FASTag signage and boards which is easily visible from the distance. Customers also can ask the toll booth person for paying through FASTag.

Yes, FASTag purchased earlier shall also work as long as it has got sufficient balance and it is not tampered.

In case the FASTag gets damaged, you as a vehicle owner / user should approach your Tag issuing bank and request them for a replacement.

A. For bank issued FASTag (i.e., FASTag purchased from a bank)

- A customer may call concerned bank’s Toll-free number written on the back side of the tag. Customer has to mention his or her user credentials (mobile number against which the tag has been registered, Vehicle Registration Number (VRN) etc). On successful verification of user credentials, requisite information shall be provided.

- Toll-free number of all banks are provided above in this document.

B. For NHAI FASTag (i.e. bank neutral FASTag)

- A customer may call 1033 Helpline number for any assistance.

FASTag shall work on all NH toll plazas and selective SH toll plazas across the country. FASTag users can travel seamlessly from one state to another state without any change in FASTag.

All discounts passes – local passes or monthly passes, exemption from Toll fees (for specific categories of vehicles) , return fare discount, etc. can be configured in the FASTag. As per Govt. rules all discounts on toll fee are applicable .

Monthly pass for a toll plaza will be issued at that particular toll plaza or the POS locations set by the Acquirer Bank of the toll plaza. If you are registered tag holder, you need to visit the toll plaza or the Acquirer Bank POS locations and request for the particular pass scheme. National Payment Corporation of India (NPCI) with the help of NHAI and banks have implemented the issuance of monthly pass on FASTag through an easy online option. Existing FASTag users can avail this facility by following the below steps:

- Open IHMCL portal www.ihmcl.co.in and Click on “Buy monthly FASTag Pass”link.

- Select the toll plaza name and enter the captcha.

- Then you will get redirected to the acquiring bank page where you can enter Tag ID or VRN (Vehicle Registration Number)

- Now select the pass type, pass scheme and continue with payment.

- You will be issued with a receipt on successful payment. Print the receipt or download for future reference.

There is no need to purchase a new RFID tag to avail a monthly pass scheme at any toll plaza. The FASTag already purchased by you can be configured with the monthly scheme.

- Duly Filled Application Form available at

- Registration Certificate (RC) of the Vehicle.

- Identification Proof (ID Proof) – Aadhaar, DL, PAN, Govt. ID Proof, VoterID.

- Proof of Exemption as applicable.

Below are the steps to apply for the Exempted FASTag through the web portal of the Indian Highways Management Company Limited (IHMCL):

Registration Process:

Step 1: Visit IHMCL website and click register yourself by providing your name, email address, mobile number and the city you reside.

Step 2: Upon successful registration, your User ID and Password will be sent to your email address.

Application Process:

Step 1: Log in to the IHMCL web portal with your Username and Password.

Step 2: Download the application form for exempted FASTag from the Dashboard Step 3: Click on the “Upload Form” and follow the process below:

-

- Select the exempted category listed on the above table

- Select the respective NHAI Regional Office (RO) to submit the application.

- Enter the exempted applicant’s name, mobile number and email address.

- Enter the vehicle registration number for which the exemptedFASTag.

- Upload the scanned copies of the below documents:

- RC of the vehicle

- ID Proof

- Proof of Exemption

- Duly filled and signed application form

Post-Application Process:

Step 1: Check the status of your application on the web portal.

Step 2: In case there are any observations, you will have to submit the required documents or clarifications to process your application.

Step 3: If your application is approved, then you will receive an approval or issuance of exempted FASTag with details to your registered email address.

Step 4: You are required to collect the exempted FASTag sticker from the respective Regional Office of NHAI.

- For Dignitaries as mentioned in Rule 11(a) exemption is available to vehicle transporting the dignitaries and accompanying security vehicle. One FASTag may be issued in the name of the dignitary/official irrespective of ownership of vehicle. Issuance of FASTag for accompanying security vehicles of such dignitaries shall be limited to Government vehicle only.

- As per Rule 11(b), vehicle used for official purpose are only exempted. In light of this, issuance of FASTag under this category should be limited to that vehicle only.

- As per Rule 11(c, d & e) namely for Ambulance, Funeral van & vehicle for persons with physical defect or disability, issuance of FASTag will require providing of requisite document in this regard by the applicant.

- Member of Parliament (MP) will be issued two FASTag, for two vehicles i.e., one for New Delhi and one for her/his constituency.

- Member of Legislative Assembly/Legislative Council (MLA/MLC) of a State will be issued one FASTag for their vehicles for the State.

The list of exempted category of mechanical vehicles as per NH Fee Rules is provided as below –

| Type of FASTag Exemption Vehicles | Code |

| Transporting and Accompanying | |

| President of India | 1 |

| Vice-President of India | 2 |

| Prime Minister of India | 3 |

| Governor of a State | 4 |

| Chief Justice of India (CJI) | 5 |

| Speaker of the House of People | 6 |

| Cabinet Minister of the Union | 7 |

| Chief Minister of a State | 8 |

| Supreme Court Judge | 9 |

| Minister of State | 10 |

| Lieutenant Governor of a Union Territory | 11 |

| Chief of Staff | 12 |

| Chairman of the Legislative Council of a State | 13 |

| Speaker of Legislative Council of a State | 14 |

| Chief Justice of a High Court | 15 |

| Judge of a High Court | 16 |

| Member of Parliament (MP) | 17 |

| Army Commander of Vice-Chief of Army Staff and equivalent in other services | 18 |

| Chief Secretary to a State Government | 19 |

| Secretary to the Government of India | 20 |

| Secretary, Council of States | 21 |

| Secretary, House of People | 22 |

| Foreign Dignitary on State Visit | 23 |

| MLA and MLC | 24 |

| An awardee of Param Vir Chakra, Ashok Chakra, Maha Vir Chakra, Kirti Chakra, Vir Chakra and Shaurya Chakra | 25 |

| Used For Official Purpose: | |

| Ministry of Defense including those eligible under the Indian Toll (Army and Air Force) Act, 1901 | 27 |

| Central and State Armed Forces in Uniform, Paramilitary Forces and Police | 28 |

| Executive Magistrate | 29 |

| Emergency/Utility Vehicles: | |

| Fire-Fighting Department or Organisation | 30 |

| NHAI/ Government Organisation utilising vehicles for the purpose of inspection, construction or operational or maintenance of national highways and survey. | 31 |

| Ambulance | 32 |

| Funeral Van | 33 |

| Mechanical Vehicles Designed for use by persons suffering from physical disability | 34 |

Yes, as per the Ministry of Road Transport and Highways, all categories of vehicles that are exempted from paying toll fee at the National Highways are required to affix the FASTag RFID sticker on their vehicle.

As per NH Fee Rule 2008 and subsequent amendments, exempted FASTags will be issued Free of cost.

No. An agency authorised by the NHAI will be the only issuer of exempted FASTag in the country.

Yes, persons or vehicles can continue to benefit from toll fee exemption upon displaying valid ID cards.

An exempted FASTag is valid for 5 years for government vehicles, while it is 1-year in case of private vehicles.

The exempted FASTag is valid for the respective tenure of parliament or assembly.

Exemption shall be extended only when the vehicle is used for official purpose.

Exemption is extended to mechanical vehicles specially designed and constructed for use of a person suffering from physical disability.

Yes. As per Government circulars, all exemptions such as monthly pass, local exemption, return journey discount etc. can be availed through FASTag only. Local exemption can be configured at the Toll Plaza level itself.

Customers can call up customer care of the issuer agency and block his / her FASTag account.

(In fact, there has been instances where stolen vehicles were able to recovered swiftly because of transaction reported from toll plazas through FASTag, which helped the law enforcement agencies to nab the culprits.)

The original owner can close the FASTag account or wallet by reaching out to the concerned issuer bank. And a new owner can get a new FASTag from any of the 26 issuer banks.

You will need to call customer care number of the issuer agency to block your FASTag. Once you take a new account, the issuer agency will transfer the balance to the new account.

The original owner can close the FASTag account or wallet by reaching out to the concerned issuer bank. And a new owner can get a new FASTag from any of the 26 issuer banks.

Customer can call the Toll-Free customer care number of concerned issuer bank or reach out to NH Helpline 1033 number. Further escalation may be sent to NHAI/IHMCL for grievance redressal.

MORTH/NHAI/IHMCL has launched 1033 helpline number for addressing FASTag complaints at toll plaza level. Customer can simply dial 1033 from Mobile/Landline for the following issues:

- Stopped at the plaza for Tag blacklist reason even though Tagis not blacklisted.

- Plaza not accepting FASTag

- Plaza not able to read the Tag

- Plaza not supporting for monthly pass issuance

- Any other applicable issue for FASTag

We would request you to kindly contact your issuing bank’s customer service desk to raise a complaint regarding the delayed delivery of FASTag.

If the customer care number for issuer banks is not working/responding what is the alternate option?

One may lodge the compliant t can call on your bank call center number and register your complaint and for any escalation drop an email at etc.nodal@ihmcl.com

MyFASTag is a mobile application which can be downloaded from the Google Play store (Android) or App Store (iOS). It is basically a consumer app which will allow them to purchase FASTags while also letting them recharge their FASTag accounts. Transactions on FASTag can also be tracked by the MyFASTag app. Consumers can also get their grievances addressed through the app.

Some of the features of the MyFASTag app have been listed below:

- It is an app specially designed for consumers. The app is extremely user-friendly.

- Purchasing and recharging of FASTag are made easy and hassle-free by this app.

- Consumers can get their grievances addressed with the help of this app.

- All FASTag transactions can be tracked using the MyFASTagapp.

- Real-time balance in the FASTag wallet can also be checked through this app.

To download the MyFASTag App, you can follow the below-given steps:

- Visit Google Playstore or App store on your Android or iOS device.

- Type ‘MyFASTag’ on the search bar.

Once you find the app launched by NHAI, use the ‘Download’ button to install it.

It allows motorists to buy FASTtags online, find offline point-of-purchase locations, recharge the stickers, and make payments and access highway helplines. The app has two main sections – NHAI FASTag (bank-neutral) and Bank Specific FASTag

Using FASTag status facility, one may check the real-time balance in the FASTag wallet assigned with the vehicle number.

Similar to the “You are Safe” feature in Aarogya Setu App, a new feature to show the Tag Balance status has been introduced on My FASTag App. This new feature shall show the real-time FASTag wallet balance in form of colour code –

- Green for Active tag with sufficient balance

- Orange for tags with low balance and

- Red for blacklisted tags.

This feature shall help FASTag user with sufficient FASTag wallet balance to pass through a toll lane by showing the tag status of the assigned vehicle, in case the tag status has not been updated in the toll plaza server due to various reasons.

Bank Helpline numbers

NHAI FASTag Helpline No. – 1033

| Bank Name | Contact Number |

| Airtel Payments Bank | 400/8800-688-006 |

| AU Small Finance Bank | 1800-258-7300 |

| Axis Bank Ltd | 1860-419-8585 |

| Bank of Baroda | 1800-103-4568 |

| Bank of Maharashtra | NA |

| Canara Bank | 1800-103-3568 |

| Central Bank of India | 1800221911 |

| City Union Bank Ltd | 1800-258-7200 |

| Cosmos Bank | 1800 233 0234 |

| Equitas Small Finance Bank | 1800-103-1222 |

| Federal Bank | 1800-266-9520 |

| Bank Name | Contact Number |

| FINO Payments Bank | 022-6868-1414 |

| HDFC Bank | 1800-120-1243 |

| ICICI Bank | 1800-210-0104 |

| IDBI Bank | 1800-266-1962 |

| IDFC First Bank | 1800-266-9970 |

| Indian Bank | NA |

| IndusInd Bank | 1860-210-8887 |

| J&K Bank | 1800 572 1370 |

| Karnataka Bank | 18005722061 |

| Karur Vysya Bank | 1800-102-1916 |

| Kotak Mahindra Bank | 18-602-666-888 |

| Bajaj Finance Ltd. | 18002100260 |

| Bank Name | Contact Number |

| Nagpur Nagarik Sahakari Bank | 1800-266-7183 |

| PAYTM Bank | 1800-120-4210 |

| Punjab National Bank | 1800-419-6610 |

| Saraswat Bank | 1800-229-999/1800-266-5555 |

| South Indian Bank | 1800-425-1809 |

| State Bank of India | 1800-110-018 |

| Thrissur District Cooperative Bank | 18004255705 |

| UCO Bank | 18005721371 |

| Union Bank of India | 1800-258-6400 |

| YES BANK | 1800 103 5485 |

| Dombivali Nagari Sahakari Bank | 1800-233-1700 |

| LivQuik Technology (India) Pvt Ltd | 18003092225 |